Describe Debt Using a Call Option

Wesleys debt is zero coupon debt with a 5-year maturity and a yield to maturity of 8 EAR effective annual rate. Maturity 5 years Assets E D 25 20 525 20 500 250 750 million Strike price D 250 million b.

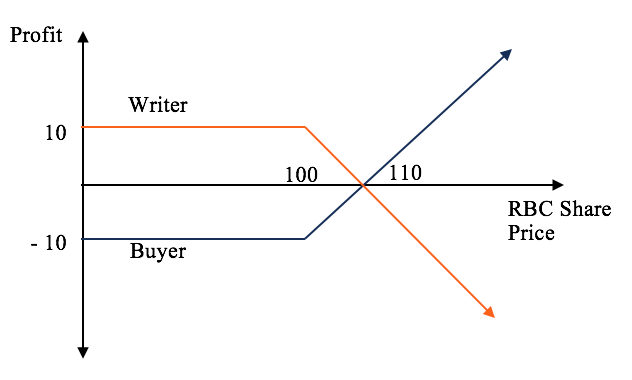

Options Calls And Puts Overview Examples Trading Long Short

Ii From a debt holder perspective describe a companys debt using a call option.

:max_bytes(150000):strip_icc()/dotdash_Final_Which_Vertical_Option_Spread_Should_You_Use_Sep_2020-02-e39443c065bb471fb4d69e6cb58f19dc.jpg)

. Long the firms assets and short the equity call option above c. As a continuation of the above the potential gain in a call option is unlimited due to no mathematical limitation in the rising price of any underlying whereas the potential gain in a put option will. In this guide Ill explain how trading options can put you into debt and what you need to avoid it.

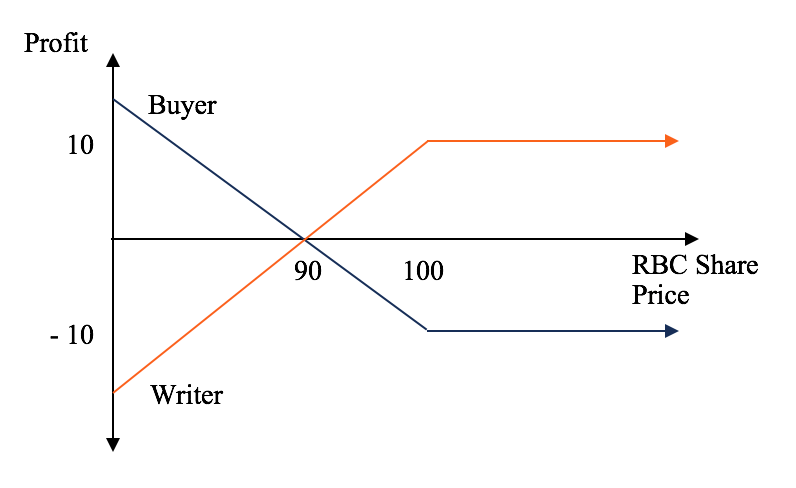

Another form of debt financing is bond issues. You can also trade with no debt. The buyer of the call option earns a right it is not an obligation to exercise his option to buy a particular asset from the call option seller for a stipulated period of time.

Iii Suppose 𝑐 and 𝑝 are option prices ie. From a debt holder perspective describe a companys debt using a call option. C Describe Wesleys debt.

Stock is trading for 30 per share. The call option generates money when the value of the underlying asset is rising upwards whereas the put option will extract money when the value of the underlying is falling. A put option is bought if the trader expects the price of the underlying asset to fall within a certain time frame.

Select from the drop-down menus Buy the firms assets and long an equity call option with a strike price equal to million. The buyer of the call option has the right but not the obligation to buy an agreed quantity of a particular commodity or financial instrument the underlying from the seller of the option at a certain time the expiration date for a. At maturity 𝑡 𝑇.

The current price of Up stock is 120 and the stock has a standard deviation of 40 per year. A traditional bond certificate includes a principal value a term by which repayment must be. The call has a strike price of 100 and expires in 90 days.

Lets get into it. Long risk-free debt and short a put option on Wesleys assets with a 5-yr maturity and 250 million face value. Finance questions and answers.

If youre new to trading you might be wondering if options trading can put you into debt. You can request for your textbook to be answered. The firms assets and longshort.

If a call option is included with a bond the bond indenture will outline the specific terms under which the issuer may call the bond. A callable bond redeemable bond is a type of bond that provides the issuer of the bond with the right but not the obligation to redeem the bond before its maturity date. While you may get the book resolved within 15-20 days subject to expert availability and can access.

At time 𝑡 0. This generates income but gives up certain rights. Call option is a derivative contract between two parties.

What is the maturity of the call option. These bonds generally come with. Describe Wesleys debt using a put option.

Maturity 5 years Assets E D 25 20 525 20 500 250 750 million Strike price 250101 5 40263 million b. Puts and calls can also be written and sold to other traders. A call option is bought if the trader expects the price of the underlying asset to rise within a certain time frame.

Describe Wesleys debt using a call option. It does not mandate that the bond issuer redeem the bond early. The choice is up to you.

A call option often simply labeled a call is a contract between the buyer and the seller of the call option to exchange a security at a set price. Long the firms assets and short the equity call option above c. Describe Wesleys debt using a call option.

A callable bond allows the issuing company to pay off their debt. Calls give the holder the right but not the obligation to buy bonds at a pre-set. The risk-free interest rate is 618 per year.

Call provisions are most commonly limited by time. However it doesnt have to. Rebecca is interested in purchasing a European call on a hot new stock Up Inc.

What is the strike price of this call option. Wesley has 24 million shares outstanding and a market debt-equity ratio of 049. Describe Wesleys debt using a put option.

Describe Wesleys equity as a call option. Select from the drop-down menus. At maturity if the value of the company asset is greater than the maturity value of the debt 𝐴𝑇 𝐷𝑇 the company will simply pay off the debt.

Otherwise the company will declare bankruptcy and debt holders will own the firm. Debt options are derivatives contracts that use bonds or other fixed-income securities as their underlying asset. What is the market value of the asset underlying this call option.

Describe Wesleys debt using a put option. Banks will often assess the individual financial situation of each company and offer loan sizes and interest rates accordingly. In describing Galts equity as a call option the market value of the assets underlying the call option is.

In your answers identify the positions that the debt holder takes on each asset ie. Round to two decimal places c. A callable bond also known as a redeemable bond is a bond that the issuer may redeem before it reaches the stated maturity date.

Describe Wesleys debt using a call option. A common form of debt financing is a bank loan. Option with a strike price equal to million.

So you will find all the answers to questions in the textbook indexed for your ease of use. Describe Wesleys debt using a call option. A call provision is an option not an obligation.

It merely confers the option to do so. I am unable to find the book I need. Galt Industries has a debt-equity ratio of 04 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8.

The callable bond is a bond with an embedded call option. Long risk-free debt and short a put option on Wesleys assets with a 5-yr maturity and 40263 million face value. When the debt falls due if the value of the operating assets is higher than the amount of the debt to be repaid the shareholders exercise their call option on the operating assets and pay the creditors the amount of the debt outstanding.

Describe Wesleys debt using a call option. Describe Wesleys debt using a put option.

Options Calls And Puts Overview Examples Trading Long Short

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Apr_2020-01-444533c81f1a408d93bb4599cc86f3b6.jpg)

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

No comments for "Describe Debt Using a Call Option"

Post a Comment